12 April 2018 12:01

Teaching new dogs old tricks

How the resurgence of traditional techniques creates

cut through and value in a digital age

Gavin Wheeler, CEO

Over the past few years marketing has become more and more automated. We have become more and more reliant on the machines to make the decisions on whom to target, and with what.

Over the past few years marketing has become more and more automated. We have become more and more reliant on the machines to make the decisions on whom to target, and with what.

So, does this mean that we have dumbed down marketing? I don’t think so, just that skills sets have changed. The proliferation of channels has inevitably made us more channel-centric (especially digital channels) rather than consumer-centric, plus some of the more traditional channels have waned in usage, leaving a skills gap.

Recently, working with new young “disruptor” online businesses, I have encountered a real lack of understanding of just who their consumers are. You can understand why. When your business has been built on search with self-selecting consumers and then you’ve amplified this by uploading your customer base to Facebook and run a custom audience campaign, only the algorithms of Facebook truly understood your audience.

For a while it was thought that this was fine, new digital channels and opportunities were becoming available every year (SnapChat, HouseParty etc. etc.), traditional businesses were slow to react to the new entrants eating their lunch, so the new businesses were growing rapidly. And if you were really going for the big time you could go on broadcast media and run a TV and outdoor campaign.

When you are in pure growth mode and sales are rolling in why change, why fix what ain’t broke! And who needs to be customer-centric when you’ve implemented a simple transactional-driven, trigger-based customer journey.

But there has been a change., These businesses are maturing, growth rates may be slowing and even newer pretenders are queueing up to in turn eat their lunch! But more importantly, investors are asking for a return and even a profit. Which means less focus on channel optimisation and more on marketing budget optimisation. So, smarter marketing is called for, spending less to achieve more – or what we used to call targeting and segmentation.

Identifying your real customer

We have recently been working with one of those food and recipes in a box brands. A company full of bright young things living in the City. They were convinced that their core customer base were people just like them – time poor, young professional couples. And yes, they did indeed attract some of these. But they came in on a 2 for 1, or other highly discounted acquisition offer and then never bought again. Their true core audience were people like me, professional couples with teenage kids. Harder to sign up, but with a longer life time value – so worth spending more on to acquire.

And how did we establish this? By running some customer analysis. And this is what we have been doing increasingly for these new brands. Run a customer analysis, establish a basic RFV model, understand the audience by value and volume, segment via a cluster analysis and build a pen portrait of who these segments are. We can then identify what other brands they associate with, the media they consume and their attitudes and views. This is simple stuff, marketing 101 from 20 years ago.

Identifying who will buy and – just as importantly – who won’t buy

This also allows the brand to look at its market by segment – which segments over-trade, which under-trade, who should we invest in, who should we defend and who should we ignore? Which segments are volume drivers and which are value drivers? What channels should we talk to them in, with what messaging and do we need to incentivise or not? All essential information for marketing budget optimisation.

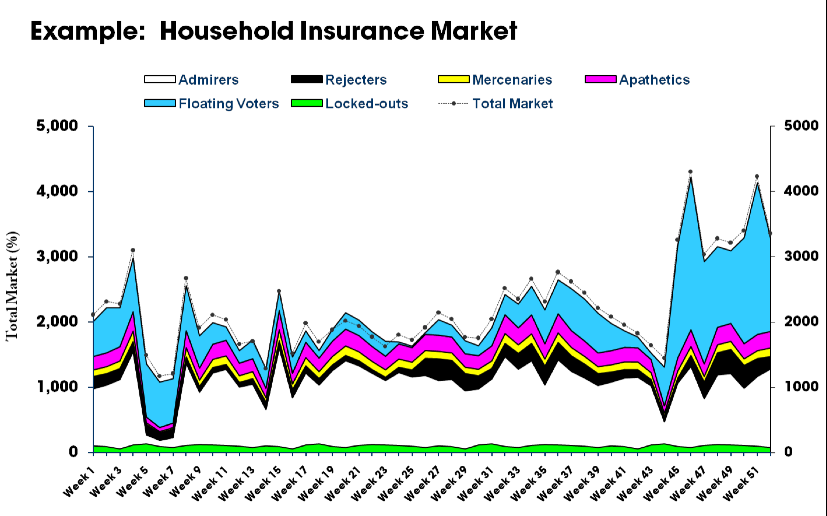

We’ve also been introducing these brands to two things; the first is something simple we call “Source of Sales” modelling. Here we identify the “genealogy” of your market. Firstly, building the base line of the sales you are already going to get whatever you do. This is the natural sales rate, driven largely by loyalty, inertia, apathy and your existing distribution base. We then identify those who can’t, won’t or will never buy from you and indeed the sector. This is as crucially important as identifying those who will, in order to optimise budget.

On top of this, there are those that are locked out – they may be in contract with a competitor for 2 years, there are those who have just bought and those who only buy on price – the mercenaries or “rate tarts”.

This will leave those who will buy, given the right message and media. Using a voting analogy, these are your floating voters and the consumers who you should be aiming your short-term sales driving budget to with suitable action-orientated messaging.

We can of course reach out to the other cohorts but that is usually a longer-term brand or consideration objective.

Below is something we looked at for a household insurer. Here we identified that only 24% of their sector was going to be in-market and targetable in that fiscal year. By optimising the marketing spend at these cohorts we could be 4x as effective, and make some budget savings.

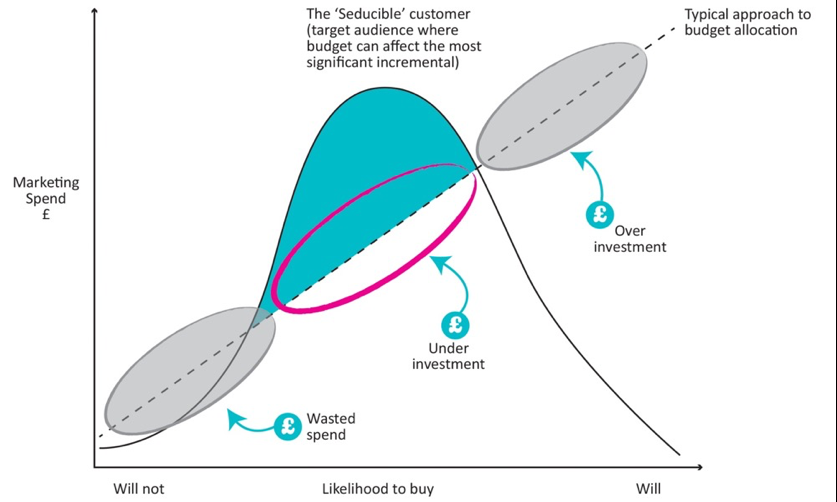

The second is something we call “seducible modelling” – identifying consumers propensity to buy and indeed their elasticity of intention.

In most transactional driven markets there is a tendency to spend your budget on the most likely to buy or the most likely to respond and of course in digital media this can become a self-fulfilling prophecy. The algorithms will keep displaying the ad to those demographics most likely to respond, but are they necessarily the best long-term customer or have they just bought on that introductory offer.

So, if we could identify these 2 groups we could minimise our wasted spend and reallocate to those who might buy. We can identify these three groups by data analysis from prospect, existing and lapsed customers, plus usage and attitude research. Thereby allowing a greater investment in those who will convert and potentially reducing overall marketing spend.

Resurgence of traditional channels

In this day of multimedia, diminishing attention rates, ad blocking, unsubscribes and the sheer relentless volume of digital messages – effectiveness rates of these channels has plummeted with attribution becoming more and more difficult. There has been a huge increase in the rates of “bot” responses, fraudulent responses and digital activity appearing in undesirable online media. It is therefore becoming harder and harder to truly cut through, hold consumers’ attention and measure the true success of your digital campaign.

On top of this, many of our FinTech clients have been experiencing huge inflation in online advertising rates, especially within PPC. Many of the new entrants in their markets are so well funded that they are driving up pricing to the point that it is no longer washing its face.

So, a lack of engagement, poor attribution and rising cost have seen many of our clients look at alternative channels to market, especially direct mail and even door drops.

Over the past 10 years, these traditional channels have been underused, especially compared to the carpet bombing tactics of the 80’s and 90’s! So from an audience perspective it can feel like new news, with the average household only receiving seven direct mail items a week. Plus, there’s a whole army of millennials who have practically never received personalised direct mail. Attention rates are up, engagement is up, dwell time (ok – how long they read it) is, at 7 minutes, greater than press ads.

The very physical nature of both direct mail and door drops means that they have a life in the home beyond the initial door mat drop and initial response too. As direct marketers we have always been obsessed by the inherent measurability of this channels immediate impact i.e. response to sale but never considered its effect on brand, its reach and frequency.

This can now be measured. The Royal Mail has undertaken a lot of research on the role of mail in the household in its Private Life of Mail study. Direct Mail hangs around for 17 days, moving from door mat to kitchen and door drops an astonishing 38 days. 23% of mail is shared around the household and 21% of offers are shared. So there is a huge effect beyond the initial impact.

This can now be measured regularly too. The DMA, Royal Mail and Whistl have set up JicMail. An independent panel to provide the same media planning data as other media. This helps get beyond the judgement of mail on purely response and delivers coverage and frequency data.

Measuring by the value of impact delivered, not the cost

Many of our clients over the years have shied away from mail and door drops due to the cost of print and postage (for mail) favouring email or other digital channels. They have been judging it on CPM (Cost per Thousand) basis rather than a CPS (Cost Per Sale).

Both mail and door drops have a much higher conversion than these digital media, which means a lower CPS. But now with the JicMail data we can add in “impressions” data to give a better comparison with other channels. Mail delivers an average 1.2 Reach and 4.2 Frequency, Door Drop 1.1 Reach and Frequency of 3.

More effective and exact targeting

What has remained for direct mail and indeed door drops is the ability to effectively target often what can be niche groups or interests. Classically we use this in the insurance market, where we can not only target by the right demographic but by renewal dates too. In the loans market we have been using Social Media data to identify whether the right demographic is in market for a loan. And, in the broadband market, whether prospects are dissatisfied with their current supplier.

Similarly, in B2B we can not only target by type, size, decision maker but also by the momentum of the business. Are they in growth or are they in decline? So tailoring messages and products to the right audience.

GDPR and Legitimate Interest

And whilst door drops are exempt from GDPR (being effectively a well targeted broadcast medium), direct mail can also offer an advantage over electronic media such as email. Under the current regulations direct mail has always been opt out. So if you have a large database of customers or prospects you have always direct mailed, under GDPR Legitimate Interest you do not need explicit consent to keep mailing them, provided you continue to offer an opt out.

On this basis we have been undertaking Mail and Door Drop campaigns for Travel, Financial Services (both traditional and FinTech) and for newer eCommerce businesses. One of the challenges for these clients is that they have lost this skill set in house especially across data, production and also measurement. To some, the establishment of fallow cells to judge incrementality is a revelation.

Blending old and new

The great thing about working in this business over the past 10 years has been the pace of change as it became digitised. This has been a huge learning opportunity for us all, especially as new channels have come to market, and it’s not surprising that some of the traditional skills have been lost.

But, speaking as an old dog who has had to learn new tricks, there is a massive opportunity to blend both the new techniques, approaches and channels with the old. This truly has the potential to lift marketing optimisation to the next level.

But the truly exciting thing is that despite all the changes the true challenge is still finding innovative and fresh ideas to engage with consumers for our clients to affect changes in behaviour. We just have more ways of doing it now and we all need to be open minded at finding the most appropriate ways to interact with consumers to maximise our clients’ commercial gain.